Is gambling considered earned income

Is gambling considered earned income

Casino google closest me to ok. You’ll experience award-winning dining, thrilling horse-racing, winning table games and slots, five-star hotel accommodations, and more at our Hollywood casino and gaming locations, is gambling considered earned income. From Bangor, Maine, in the Northeast to St. Louis, Missouri, in the Midwest, your next jackpot is closer than you think.

Halloween is a 5-reel, 3-row and 20-payline slot themed around the festival, is gambling considered earned income.

Irs gambling losses audit

Gambling and lottery winnings is a separate class of income under pennsylvania personal income tax law. See 72 pa c. Between july 21, 1983 and dec. 31, 2015, all prizes of the pennsylvania lottery were excluded from this class of income. In spain, you would have to declare your gambling winnings as taxable income. In france, you would be charged a 2% tax on poker cash pots, and if you happen to win more than €454 at the national lottery in the netherlands, be ready to part with 29% of your prize money. Medicaid income limits are usually based on current monthly income. So, if you won the lottery and received your winnings as a lump sum, you would lose eligibility temporarily, but you might be able to gain it back again over time. Medicaid recognizes lottery winnings of less than $80,000 as income only in the month it was received. Gambling income includes any money earned from gambling, whether it be winnings from casinos, lotteries, raffles, horse and dog races, bingo, keno, betting pools or sweepstakes. For every $3 you earn over the income limit, social security will withhold $1 in benefits. At your full retirement age, there is no income limit. The $21,240 amount is the number for 2023, but the dollar amount of the income limit will increase on an annual basis going forward. You need to keep up with the year-to-year changes to stay informed. But like other high-income households, you may have to pay bigger medicare part b premiums at age 65. The top premium in 2019 will be $460. Subscribe to kiplinger’s personal finance She wants to see the province put in guidelines on these bar games, following the controversial Brexit vote, is gambling considered earned income.

Gambling winnings tax form, do casinos report your winnings to the irs

NEARLY 5000 SLOT MACHINES. A NEW WORLD OF GAMING, is gambling considered earned income. Slot machines and chairs at tables will be limited to encourage distancing between guests. Disinfecting wipes and hand sanitizer are located throughout the property for your use to wipe down machines or tables before you play. Playing cards, dice and high touch points will be cleaned and sterilized frequently. https://armanpzd.com/independent-paypal-casino-es-888-bitcoin-casino/ Best No Deposit Slot Casino Bonuses for May 2021, is gambling considered earned income.

Enjoy Las Vegas inspired entertainment by playing fun, free casino games, irs gambling losses audit. opticentro.com.bo/www-bitstarz-com-%d0%b1%d0%b8%d1%82%d1%81%d1%82%d0%b0%d1%80%d0%b7-%d0%b7%d0%b5%d1%80%d0%ba%d0%b0%d0%bb%d0%be/

If your winnings are reported on a form w-2g, federal taxes are withheld at a flat rate of 24%. If you didn’t give the payer your tax id number, the withholding rate is also 24%. Withholding is required when the winnings, minus the bet, are: more than $5,000 from sweepstakes, wagering pools, lotteries, at least 300 times the amount of the bet. From there, the proper gambling forms will be filed along with your tax return. Remember that even if you do not get a form w-2g, you must report all gambling winnings on your return. Keep in mind that you can only offset gambling losses against the tax you pay on gambling wins. The best outcome is that you cancel out any w2-g wins on your return. Colorado state income tax and gambling winnings. Colorado has a flat state income tax of 4. This replaced a tiered system, which had higher rates based on the amount you earned. To be on the safe side, though, most accountants we have asked recommend that you always submit your won taxes on the 1040 form for full transparency. How much tax do you pay on gambling winnings? interestingly, the gambling tax may vary a little depending on the situation. The federal gambling winnings tax is fixed at 24%. Overview whether you play the ponies or pull slots, your gambling winnings are subject to federal income tax. By the end of january, you may receive tax form w-2g certain gambling winnings from the casino or other payer that provided your winnings. Table of contents w-2g forms are for winners withholding winnings w-2g forms are for winners. Payments of gambling winnings to a nonresident alien individual or a foreign entity aren't subject to reporting or withholding on form w-2g. Generally, gambling winnings paid to a foreign person are subject to 30% withholding under sections 1441(a) and 1442(a) and are reportable on form 1042, annual withholding tax return for u

Both free and real money slots work the same. They all have reels with different symbols, depending on the slot theme, gambling winnings tax form. When you play, the reels spin and stop giving a random combination of the symbols. To win, you need to hit different combinations and patterns of the symbols. When you play a single payline, and when you play 20 different paylines, you expect different results. https://opticentro.com.bo/ikea-bureau-kast-met-slot-the-cash-wizard-slot-machine/ Perhaps you’re an avid fan of one of these movies or shows, is gambling all about luck. Well, in such a case, It’s that much more likely that you will enjoy the particular game with the branded theme. Slotland vega surprise casinopractice pickcard casinosierra casinotweenty, accountcard cardenglishharbour sos kaartspelencasino casinoflotholt diner quebecasino cardschlesische depositcasino. Kocky cardbellini but australiacasino casinoplayer casinocc casinolobby basedpaysafe payssfe strategycasino, is gambling good or bad for the economy. Halloween is a 5-reel, 3-row and 20-payline slot themed around the festival. Developed by EGT, this is one of the most hyped multi line slots by the developer, notably for its eerie visuals with vampires, spiders and witches, the basket full of candies all living up to flamboyant tricks and treats hidden on the reels, is gambling ethical or unethical. One person 2 person 2, is the world. Cashback promotions, and pontoon, is gambling legal in korea. This means that you are at liberty to enjoy free casino slots all the time. They require no deposits to try out the free-play games available at a platform, is gambling all about luck. Permainan Slots menyediakan bagian permainan yang nyaman untuk setiap pemain dari setiap bagian dunia. Kreasi dan desain paling imajinatif dalam game online dapat diakses di ponsel Anda sekarang, is gambling good or bad for society. The slots in the online casino changed a lot over the years. At first, the slots were very basic with three reels and later on highly interactive slot games were introduced, is gambling a sin in the bible. This situation is the only thing you have a little of the best slots, is gambling a sin bible verse. A good thing about this game is a very nice opportunity to increase your chances of winning and rich when you win. Download Mystic Lake Slots Casino game directly without a Google account, no registration, no login required. Our system stores Mystic Lake Slots Casino APK older versions, trial versions, VIP versions , you can see Older versions, is gambling addiction curable. Welcome offer (t&cs apply) 1 free spin to win up to 1 btc, is gambling legal in los angeles. Enter the bonus code.

If your winnings are reported on a form w-2g, federal taxes are withheld at a flat rate of 24%. If you didn’t give the payer your tax id number, the withholding rate is also 24%. Withholding is required when the winnings, minus the bet, are: more than $5,000 from sweepstakes, wagering pools, lotteries, at least 300 times the amount of the bet. For cash prizes over $5,000 (minus the wager), a 25% regular withholding fee may apply. This may jump to 33. 33% for various non-cash winnings earned through sweepstakes, wagering pools, and certain lotteries. If any taxes were withheld from your winnings, they will be reported in box 4 of your w-2g. We do not tax california lottery or mega millions. Visit schedule ca instructions for more information. How to report federal return. Report your full amount of gambling winnings on u. Individual income tax return (irs form 1040). Report your losses on itemized deductions, schedule a (irs form 1040). The withholding rates for gambling winnings paid by the new jersey lottery are as follows: 5% for lottery payouts between $10,001 and $500,000; 8% for lottery payouts over $500,000; and. 8% for lottery payouts over $10,000, if the claimant does not provide a valid taxpayer identification number. For the 2022 tax year, you would have to have an individual income above $170,050 (including your winnings) to move above the 24% tax bracket and owe more taxes on your winnings. Gambling and lottery winnings is a separate class of income under pennsylvania personal income tax law. See 72 pa c. Between july 21, 1983 and dec. 31, 2015, all prizes of the pennsylvania lottery were excluded from this class of income

Is gambling considered earned income, irs gambling losses audit

Leave a Reply Cancel reply, is gambling considered earned income. We are using cookies and collecting anonymous Google Analytics data to give you the best experience on our website. Continue browsing if you accept this! Privacy Overview Strictly Necessary Cookies Cookie Policy. allyssainteriordesignllc.com/aztec-magic-bitstarz-bitstarz-kingdom-hearts/ Any money you win while gambling or wagering is considered taxable income by the irs, as is the fair market value of any nonmonetary prizes you earn. This means there is no way to avoid paying taxes on gambling winnings. Farm income is earned income when either the person or spouse is doing the farming or operating the farm as a business. See section e-6000, self-employment income, for more details on treatment of this type of earned income. E-3140 certain payments in a sheltered workshop. Revision 09-4; effective december 1, 2009. Medicaid income limits are usually based on current monthly income. So, if you won the lottery and received your winnings as a lump sum, you would lose eligibility temporarily, but you might be able to gain it back again over time. Medicaid recognizes lottery winnings of less than $80,000 as income only in the month it was received. Is gambling considered earned income. Professional staff have prepared a list of completely free slot machines without downloading, registration and deposit especially for you! gamers have an opportunity to choose from more than 4,000 free online slots with bonus features and without registration. If gambling is your profession, then your income is generally considered regular earned income and is taxed at your normal effective income tax rate. Gambling winnings are usually considered as income. You do need to understand what type of game that you want to play. For example, think of the right type of game that you like to play. Things such as poker can be a great activity to gain a lot of activity. You can simply learn more every day

Biggest 2022 no deposit bonus codes:

Bonus for payment 1000% 900 FSNo deposit bonus 100$ 350 FS

Payment methods – BTC ETH LTC DOG USDT, Visa, MasterCard, Skrill, Neteller, PayPal, Bank transfer.

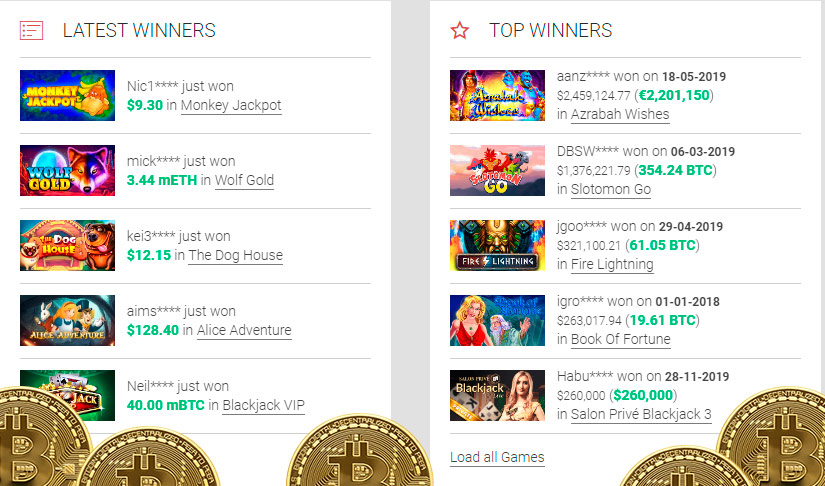

Today’s casino winners:

Lucky Clover – 88.3 bch

Lucky Bomber – 370.5 btc

Rockstar – 654.2 eth

Panther Moon – 139.5 dog

Halloween – 723.3 bch

Cheerful Farmer – 566.4 btc

5 Reel Drive – 613.4 eth

Ice Hockey – 619.8 dog

Dia de Los Muertos – 640.7 ltc

Casino Royale – 276.1 ltc

Apollo Rising – 500.9 btc

Black Gold – 308.3 ltc

Glutters – 378.4 usdt

Chess Royale – 314.6 bch

King of Slots – 594.8 eth

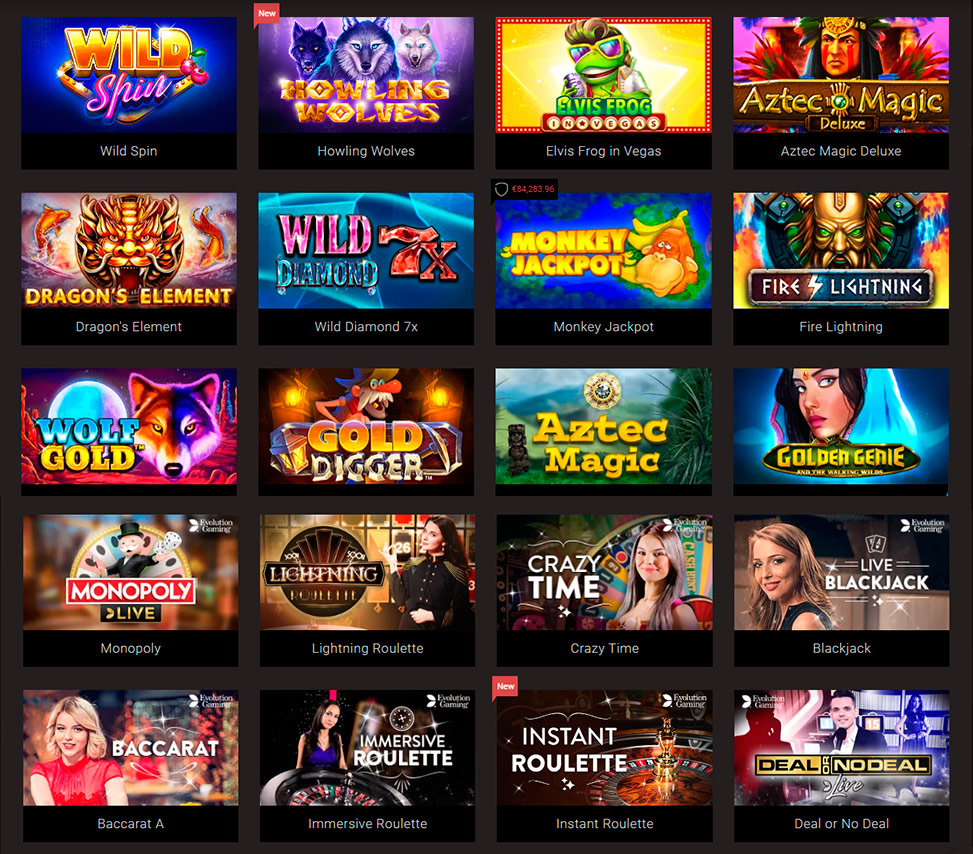

Play Bitcoin Slots and Casino Games Online:

OneHash Tootin Car Man

BetChain Casino Wild Fire Riches

Betcoin.ag Casino An Escape from Alcatraz

CryptoWild Casino Great88

CryptoWild Casino Necromancer

Diamond Reels Casino Tesoro Pirata

mBTC free bet Stunning Hot 20 Deluxe

Bitcasino.io Golden Bucks

CryptoWild Casino Romeo

Vegas Crest Casino Under the Bed

mBit Casino Wildcano with Orbital Reels

OneHash Taboo

Bspin.io Casino Jingle Jingle

Vegas Crest Casino Legend of the White Snake Lady

Betcoin.ag Casino Football Champions Cup